- MyFaith News Channel

Ask Chuck: Help Me Overcome Market Jitters

By Chuck Bentley, CP Visitor Contributor

Pricey Chuck,

We would favor to restrict our publicity in the stock market attributable to its volatility of uninteresting. What are your suggestions on T-funds?

Market Jitters

Pricey Market Jitters,

First, “market jitters” is an staunch term aged to notify “an elevated dispute of alarm and perceived uncertainty in regards to the economy or a explicit asset market,” in accordance with Investopedia.

“Uncertainty in accordance with changing financial circumstances, financial shocks, or detrimental market psychology all play a job. Market jitters can induce a flight to security into low-probability resources, but would possibly perhaps additionally be advantageous for investments and trading solutions that steal pleasure in excessive volatility.”

Genuinely, anguish of loss causes of us to steal motion by provocative out of the market or to safer investments, merely as you would possibly perhaps perhaps perhaps even be describing.

Second, I am no longer certified to present funding advice. I hope you’re going to be wanting a talented advisor or advisors/counselors that you just consult earlier than making funding choices. However, I can offer some identical old knowledge besides to biblical principles to motivate details you, as one supply of counsel.

The Bible makes it definite that we stock out no longer know the long bustle; attributable to this fact, we ought to nonetheless lower our funding probability thru diversification into diversified resources or groups of resources.

“Give a portion to seven, or even to eight, for no longer what catastrophe would possibly perhaps merely happen on earth” (Ecclesiastes 11:2 ESV).

I steal this verse to advocate for having now not more than 12–15% of your funding in a single asset or sector. So, I would recommend that you just transfer top most likely a portion of your investments to low-probability/low-yield resources.

So what about T-funds?

Most of us are acquainted with excessive-yield financial savings accounts and CDs, but but any other option is T-funds (Treasury funds), which the U.S. Treasury Division backs. They are an exact option whilst you wish shorter terms than CDs or are residing in a excessive-tax dispute. T-funds are loans made to the authorities — speedy-term debt tasks issued and backed by the authorities.

Elon Musk has described speedy-term T-funds as a “no-brainer.” On the discontinue of the 2d quarter of 2024, Berkshire Hathaway (where Warren Buffet is chairman and CEO) held $234.6 billion briefly-term investments in treasury funds. That is $130 billion greater than what the company owned at the discontinue of 2023 and surpassed The Federal Reserve’s holdings of $195.3 billion. Final Would possibly per chance also, Buffett called them “the safest funding there would possibly be.”

T-funds offer stability if a portfolio contains any excessive-probability investments. They are a safe dispute to take care of extra money. Low-probability investments are in most cases extremely liquid. However, you pay for the safety at lower rates of return.

T-funds reach briefly-term lengths of 4, 6, 8, 13, 17, 26, and 52 weeks. Auctioned off at a reduction (face designate), they are redeemed for the fats amount at maturity. The “hobby” earned is the adaptation in absorb designate and the designate at maturity. You will most likely be in a build to either redeem the money or reinvest it. If buying at this time from the Treasury, the redemption designate is deposited in your Certificate of Indebtedness (C of I) or your designated checking account the day it matures, unless directed to reinvest.

T-funds would possibly perhaps merely additionally be purchased electronically from the Treasury, a monetary institution, a dealer, or but any other monetary institution. The Treasury and colossal national brokerage corporations offer them with zero commission. The minimum absorb from the Treasury is $100 and in increments of that quantity. The “hobby” payment is fastened at public sale. Returns are proportional to the scale of the bill.

Earnings are enviornment to federal profits taxes but are exempt at dispute and native ranges. Earnings ought to be reported the 365 days they former or when sold forward of maturity. You will most likely be in a build to peep the everyday treasury bill rates right here.

What are the pros?

- Excessive liquidity.

- Low minimum funding.

- Fetch plot to diversify a portfolio.

- Tax-exempt at dispute and native ranges.

- Non permanent funding of 52 weeks or much less.

- Hobby rates aggressive with excessive-yield financial savings.

- Backed by the credit of the US authorities (no longer the FDIC).

What are the cons?

- Lower probability=lower returns.

- Taxable at the federal level.

- Diminutive to speedy-term investing.

- Field to inflation and fluctuating hobby rates.

- Prices influenced by monetary coverage, macroeconomic circumstances, and overall query/present of the treasuries.

- Fashioned administration to reinvest at maturity unless performed mechanically.

Easy how to ladder T-funds

A T-bill ladder is a scientific, structured methodology to low-probability investing. Staggering maturity dates permits investors to capture rising hobby rates to most likely broaden yield. T-funds are without anguish accessed at maturity and would possibly perhaps perhaps merely additionally be reinvested in greater-yielding T-funds or allocated in diversified locations. Laddering is a technique of diversifying maturity dates and rising a constant profits movement.

Want how noteworthy you would possibly perhaps perhaps make investments. Opt your timeframe by forecasting upcoming wants, worship the down payment for a dwelling, buying a vehicle, or planning a wedding. The following instance works smartly in scenarios of rising hobby rates; rates are in most cases greater the longer the T-bill. When rates descend, you would possibly perhaps perhaps money out at maturity or reinvest at lengths that optimize your return. Cautious repairs is required to alter a ladder when the market shifts. Fashioned exhaust of organized reminders is wanted.

Example: You would possibly perhaps perhaps perhaps also merely like $20,000 to make investments and wish 5 diversified rungs or maturity dates in your ladder. You would possibly perhaps perhaps perhaps also absorb:

- A 4-week bill that is $4,000 at maturity and then reinvested in a 26-week bill.

- An 8-week bill that is 4,000 at maturity and then reinvested in a 26-week bill.

- A 13-week bill that is $4,000 at maturity and then reinvested in a 26-week bill.

- A 17-week bill that is $4,000 at maturity and then reinvested in a 26-week bill.

- A 26-week bill that is $4,000 at maturity and then reinvested in a 26-week bill.

I hope you’re going to be wanting learned sufficient to permit you with your decision. I don’t possess it’s a ways an exact thought to soar in and out of the market. It is a ways better to make educated choices and pause the course over time. Bear in mind:

“The plans of the diligent lead indubitably to abundance, but all individuals who is posthaste comes top most likely to poverty” (Proverbs 21:5 ESV).

Quit you wish more instruments and guidelines on monetary stewardship? Are you extraordinary about receiving ministry updates from across the sector? Join to score the Crown E-newsletter emails by the exhaust of the invent on the homepage at Crown.org.

Chuck Bentley is CEO of Crown Monetary Ministries, a world Christian ministry, founded by the uninteresting Larry Burkett. He is the host of a everyday radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and creator of his newest e-book, Financial Proof for God?. Guarantee to apply Crown on Fb.

Share:

Top rated products

-

-

Heritage Communion Kit with Leather Belt Bag: A Cultural and Historical Journey

Rated 5.00 out of 5$21.90Original price was: $21.90.$19.50Current price is: $19.50. -

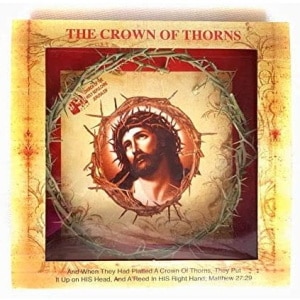

Jerusalem Passion of Christ Crown of Thorns in Gift Box -7.5"

Rated 5.00 out of 5$29.90Original price was: $29.90.$27.50Current price is: $27.50. -

Rated 5.00 out of 5

Rated 5.00 out of 5$14.90Original price was: $14.90.$13.90Current price is: $13.90. -

Related Articles

Lakewood Church Christmas Eve Threat Suspect Indicted On Federal Terrorism Charge

School District Pays Thousands To Settle With Teacher Fired For Not Using Preferred Pronouns

How Do We Keep Our Faith When Things Arent Going Right?

Teachers Should Not Lose Their Jobs Over Private Prayer

This Purim, We Should Remember Our Enemies But Especially Our Friends

Copyright

Copyright 2025 – MyFaith.Shop

By using this website you agree to our Privacy Policy.